3 5: Basic Merchandising Transactions periodic inventory system Business LibreTexts

This issue will arise as your operation grows and becomes more challenging to control positively. The content within this article is meant to be used as general guidelines in the periodic inventory system and may not apply to how to calculate total assets liabilities and stockholders‘ equity your specific situation. Always consult with a professional accountant to ensure you’re using methods best suited to your business needs. Imagine a small clothing store, Fashion Boutique, that uses the periodic inventory system.

Different between Periodic and Perpetual

So, Fashion Boutique determines that $11,000 worth of clothing was sold during the month. The periodic inventory system allows the store to focus on sales without tracking every item daily, but they only know the exact inventory levels after the month-end physical count. The periodic inventory system is an effective method of tracking inventory levels, but there are certain drawbacks that must be taken into consideration. While it can provide a useful overview of how much stock is on hand at any given time, the periodic system is slow and less flexible than other types of inventory systems.

How Do You Calculate Inventory Using a Periodic System?

In a periodic inventory system, inventory tracking is manually updated at the conclusion of a certain period. Through point-of-sale inventory systems, the perpetual inventory system keeps track of inventory by immediately documenting any alterations. In addition, continuous inventory taking is made possible because the systems maintain a running account that is updated with each sale or return. A firm may occasionally encounter product recalls, purchases return, and misplaced products in transit. However, there is no way to consider these unforeseen changes with the periodic inventory. Therefore, up to the conclusion of the next term, inventory records remain fixed.

Which of these is most important for your financial advisor to have?

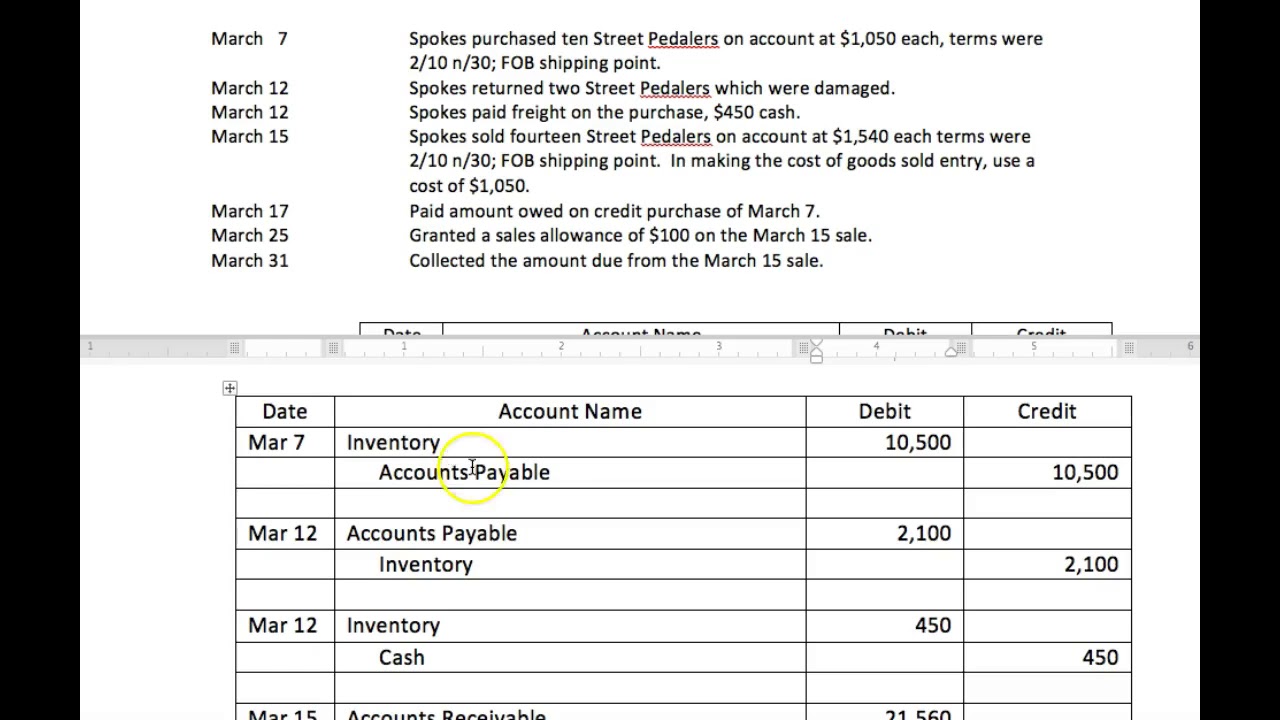

Of course, some of that inventory can become” Finished Goods” and be sold during the period, but your accountant doesn’t need to worry about that. Instead, a “purchase account” will be created in a periodic system for each bought inventory, which is an ‘asset.’ All the inventory purchases are stored in this account. When the company makes sale, they have to record accounts receivable, sales discount, and sale revenue. The journal entry is debiting accounts receivable $ 9,500, sales discount $ 500, and credit sales revenue $ 10,000. When utilising a periodic inventory system, periodic inventory taking refers to the physical count of inventory that occurs on a regular basis.

- This means that any changes in inventory from the sales or purchases the business makes that year are not recorded until December 31st.

- Learn more about how you can manage inventory automatically, reduce handling costs and increase cash flow.

- The periodic inventory system is becoming an old-fashioned method of tracking inventory, and for a good reason.

- Moreover, the periodic system will not record any cost of goods sold during the month.

- Therefore, it is important for businesses to carefully consider the pros and cons of a periodic inventory system before deciding to utilize it.

A perpetual inventory system is a software system that continuously collects data about a company’s products. A perpetual system tracks every transaction as it happens, including purchases and sales. The system also tracks all information pertinent to the product, such as its physical dimensions and its storage location. Inventory is defined as items, goods, merchandise, and materials stocked by a business to sell for profit. According to the Generally Accepted Accounting Principles (GAAP), all properties intended for sale can be considered inventory items.

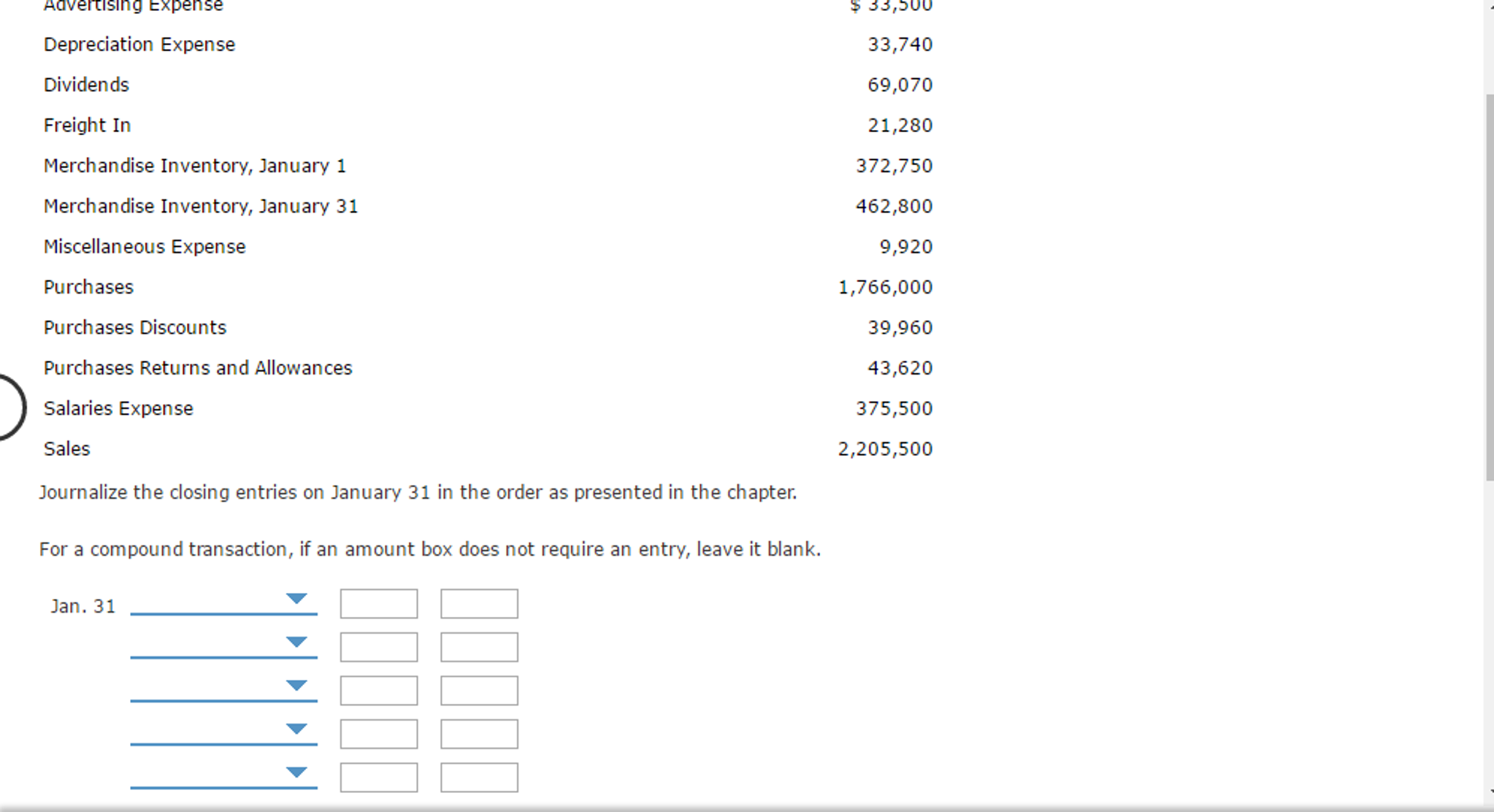

Financial and Managerial Accounting Copyright © 2021 by Lolita Paff is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. Once the COGS balance has been established, an adjustment is made to Merchandise Inventory and COGS, and COGS is closed to prepare for the next period. Build a growing, resilient business by clearing the unique hurdles that small companies face. Buyers must record shipping charges as transportation in (or Freight In) when the goods were shipped FOB shipping point and they have received title to the merchandise. Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One.

The decision as to whether to utilize a perpetual or periodic system is based on the added cost of the perpetual system and the difference in the information generated for use by company officials. There are advantages and disadvantages to both the perpetual and periodic inventory systems. As you can see, weighted average in a periodic system is a calculation done outside of the ledger.

A contra account is meant to be opposite from the general ledger because it offsets the balance in their related account and appears in the financial statements. Examples of contra accounts include purchases discounts or purchases returns and allowances accounts. Under the periodic system, new inventory purchases will be recorded into the inventory account after receiving.

So during the month, we do not know about the inventory balance and cost of goods sold at all. The inventory increase will not update, we only use the temporary account (purchase). The cost of goods sold will not be recorded as well, we only calculate it at the month-end. Periodic inventory is a very manual procedure that may be time-consuming and challenging to scale as a firm expands.

In this example, the physical inventory counted 590 units of their product at the end of the period, or Jan. 31. Record the purchase returns by debiting the accounts payable or accounts receivable account and crediting the purchase returns account. Record the purchase of inventory in a journal entry by debiting the purchase account and crediting accounts payable. You can use them to get paper inventory lists, import the stock data and calculate the data you need to order more stock and reconcile the stock you have for a new period.

The possibility of a human mistake increases when you physically count all the inventory goods you have on hand. After taking stock of all inventory, look for anomalies or statistics that seem noticeably higher or lower than anticipated to avoid this. This indicates that other techniques are more appropriate for businesses with a high inventory turnover rate, a high number of SKUs, demands for multichannel inventory management, or who want real-time data. Generally Accepted Accounting Principles (GAAP) do not state a required inventory system, but the periodic inventory system uses a Purchases account to meet the requirements for recognition under GAAP. The main difference is that assets are valued at net realizable value and can be increased or decreased as values change.