Should IRR or NPV be Used in Capital Budgeting?

The cash received in the second year is worth less than the cash received in the first year. And the cash received in the fifth year is worth less than the cash received in the first motor vehicle sales and use tax four years. Inflation is an economic concept that measures the general increase in prices and the resulting decline in the purchasing value of money over a period of time.

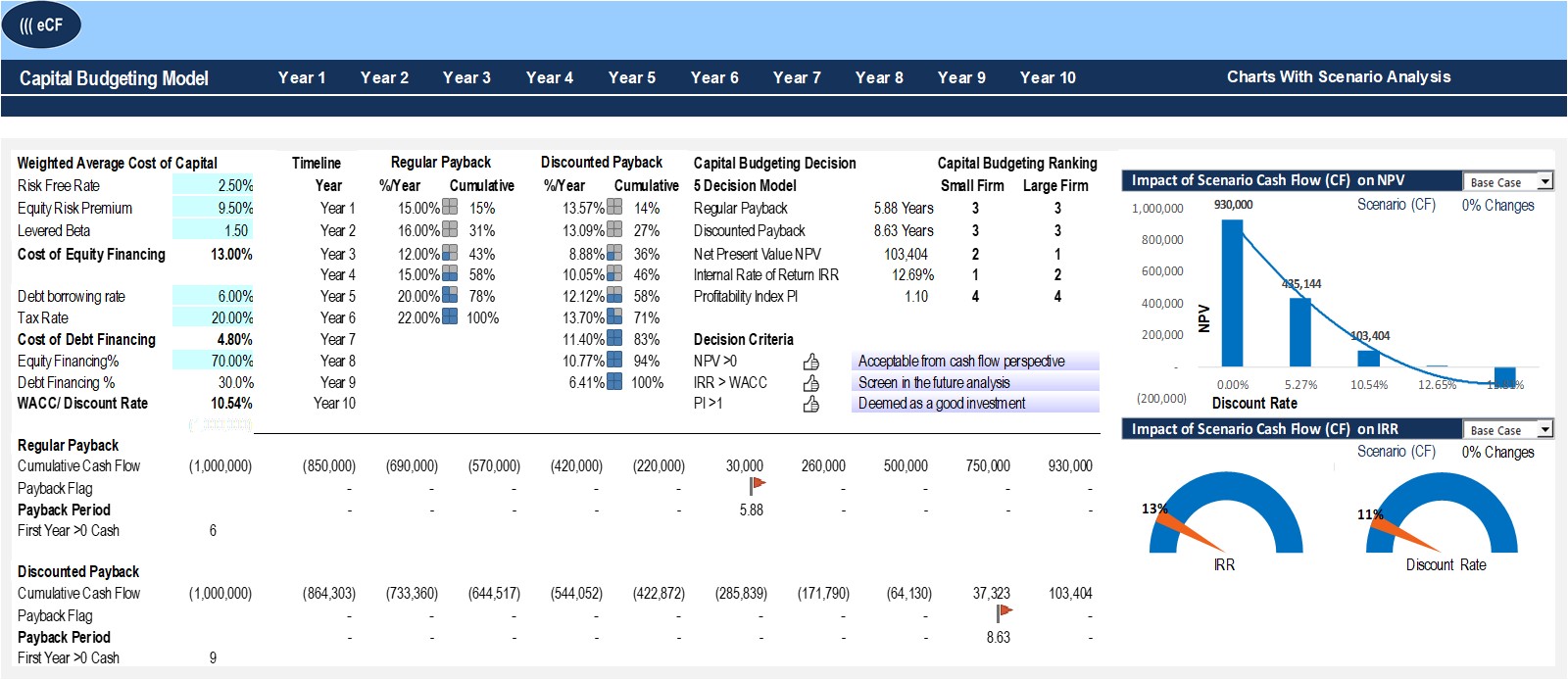

Capital Budgeting Decisions

While the payback period method is easy to use, its disadvantages are significant. First, this method does not consider the actual profitability of a project. And second, this method does not consider the time value of money. The time value of money concept states that money available today is inherently worth more than an identical amount of money available in the future. The time value of money is explored in more detail later in this chapter. The payback period method is often used as an investment screening tool rather than a final selection tool.

Financial Planning & Capital Budget

A dramatically different approach to capital budgeting is methods that involve throughput analysis. Throughput methods often analyze revenue and expenses across an entire organization, not just for specific projects. Throughput analysis through cost accounting can also be used for operational or noncapital budgeting. Also, payback analysis doesn’t typically include any cash flows near the end of the project’s life.

What is the approximate value of your cash savings and other investments?

- It shows how much profit is earned from each sale, which can be attributed to fixed costs.

- This tool can be used to identify investments that meet specific payback criteria.

- The A model would cost $420,000, generate $260,000 in annual cash revenues, and $120,000 in annual cash operating costs.

This latter situation would require a company to consider how to choose which investment to pursue first, or whether to pursue both capital investments concurrently. Capital budgets are geared more toward the long term and often span multiple years. Meanwhile, operational budgets are often set for one-year periods defined by revenue and expenses. Capital budgets often cover different types of activities such as redevelopments or investments, whereas operational budgets track the day-to-day activity of a business. Some of the major advantages of the NPV approach include its overall usefulness and that the NPV provides a direct measure of added profitability. Companies may be seeking to not only make a certain amount of profit but also want to have a target amount of capital available after variable costs.

What is your current financial priority?

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. There is every possibility that shareholders will derive the maximum benefit, which in turn results in wealth maximization. In particular, the amount invested in fixed assets should ideally not be locked up in capital goods, which may have a far-reaching effect on the success or failure of an enterprise. In the case of fixed assets, these refer to assets that are not intended for resale. Examples include land and buildings, plant and machinery, and furniture. Thus, it is a process of deciding whether or not to commit resources to a project whose benefit would be spread over the years.

Fundamentals of Capital Investment Decisions

This is a single cash flow of $10,000 that happens one time 10 years from now. Exhibit 11-4 Template to compute payback period, simple rate of return, and video explanation. Given below are the various methods of capital budgeting analysis. Some of the most important tools, however, are those to do with communication.

Net cash inflows for the Diamond LX and VIP Express are $126,000 ($73,000 + 53,000) and $148,680 ($76,980 + 71,700), respectively. The net present value method compares the present value of a project’s cash inflows to the present value of its cash outflows at a predetermined discount rate. The discount rate is the minimum rate of return established by the organization. All the cash inflows and outflows from an investment are discounted at this rate. Discounted cash inflows are positive, and discounted cash outflows are negative.

Annual net operating income resents the investment’s revenues less its expenses. Since this method uses annual net operating income, depreciation expense is included in the calculation. If annual net cash flow is given, depreciation expense must be calculated and subtracted from net annual cash flow to arrive at net operating income. Capital budgeting evaluates long-term investment projects to determine which will generate the most return on investment. On the other hand, working capital management is the process of managing a company’s short-term assets and liabilities to ensure that it has enough liquidity to meet its day-to-day financial obligations.

Managers are responsible for many decisions, some with short-term and others with long-term financial consequences. Projects and investments with long-term financial consequences are referred to as capital projects. Therefore, capital budgeting refers to the process of planning projects or making decisions that have a long-term effect on the organization. Examples of capital projects include investments in long-term assets such as vehicles, machines, facilities, or equipment; launching new products or services; and expanding operations.